A choppy performance on Wall St as stocks held onto its gains ahead of the FOMC rate decision tomorrow. China and Japan shut for holidays. ASX closed in negative territory, following surprised 25 basis rate hike. Good morning. I’m Melissa Darmawan for Finance News. This is your market outlook.

The Australian sharemarket is set to rebound after we saw a rally in stateside.

US stocks post gains ahead of Fed rate outcomeWall St posted gains ahead of the highly anticipated rate decision from the Fed as investors brace themselves for upcoming months of rate hikes amid several uncertainties weighing, with the war in Ukraine, a lockdown in China and what it means for energy prices, supply chains, and their back pocket. Apple shares posted a 1 per cent gain, so goes Apple, so goes the market.

At the closing bell, the Dow Jones gained 0.2 per cent to 33,129, the S&P 500 added 0.5 per cent to 4,175 and the Nasdaq climbed 0.2 per cent to 12,564.

It's nice to see some green after stocks come off a rough patch in the past few weeks. April was the worst month since March 2020 for the Dow and S&P 500. It was the worst month for the Nasdaq since 2008. The S&P 500 is trading in correction territory, down about 13 per cent from its record highs, but this is in line to what we’ve seen historically.

For today, the S&P 500 sectors saw two losers to the overall winners. Consumer discretionary was the worst by 0.3 per cent, then consumer staples. Energy led the pack up 2.9 per cent, and if you look under the bonnet, Exxon Mobil added more than 2 per cent and EOG Resources rose 3.8 per cent. Defensive sectors such as health care and utilities also outperformed, with Pfizer gaining nearly 2 per cent after reporting a stronger-than-expected first quarter.

The yield on the 10-year treasury note dipped by a hairline, 0.02 per cent to 2.98 per cent, gold rose on a weaker greenback.

Why?The Fed is expected to raise rates by 50 basis points and announce the unwinding of the balance-sheet. However, what is likely to spook markets is colour on the balance sheet runoff. Why? It means that liquidity will start to be zapped out of the market, and could be enough to spark a sell-off and prompt the markets to do part of the job for the Fed.

Today we also received economic data from the Bureau of Labor Statistics, showing a series high of 11.5 million job openings. This means that there are more roles open than people looking for jobs, a sign of a very tight labour market. This reinforces that the Fed can move to raise interest rates.

Given the uncertainty, volatility is here to stay and that these wild swings could remain high as the bears and bulls emerge to create a choppy performance. The question is, will the sell-off or the rally be sustained?

What I want to show you is the

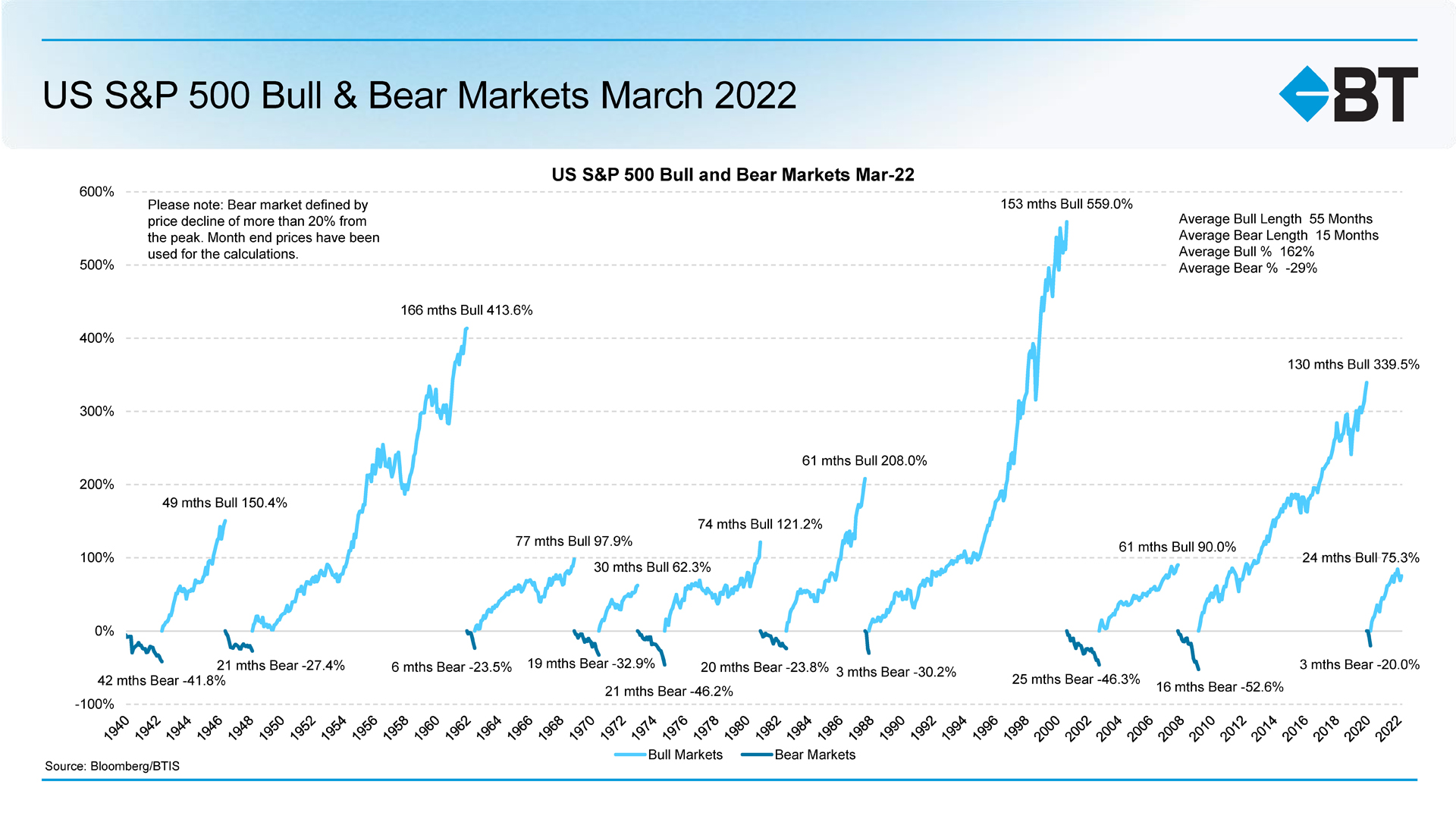

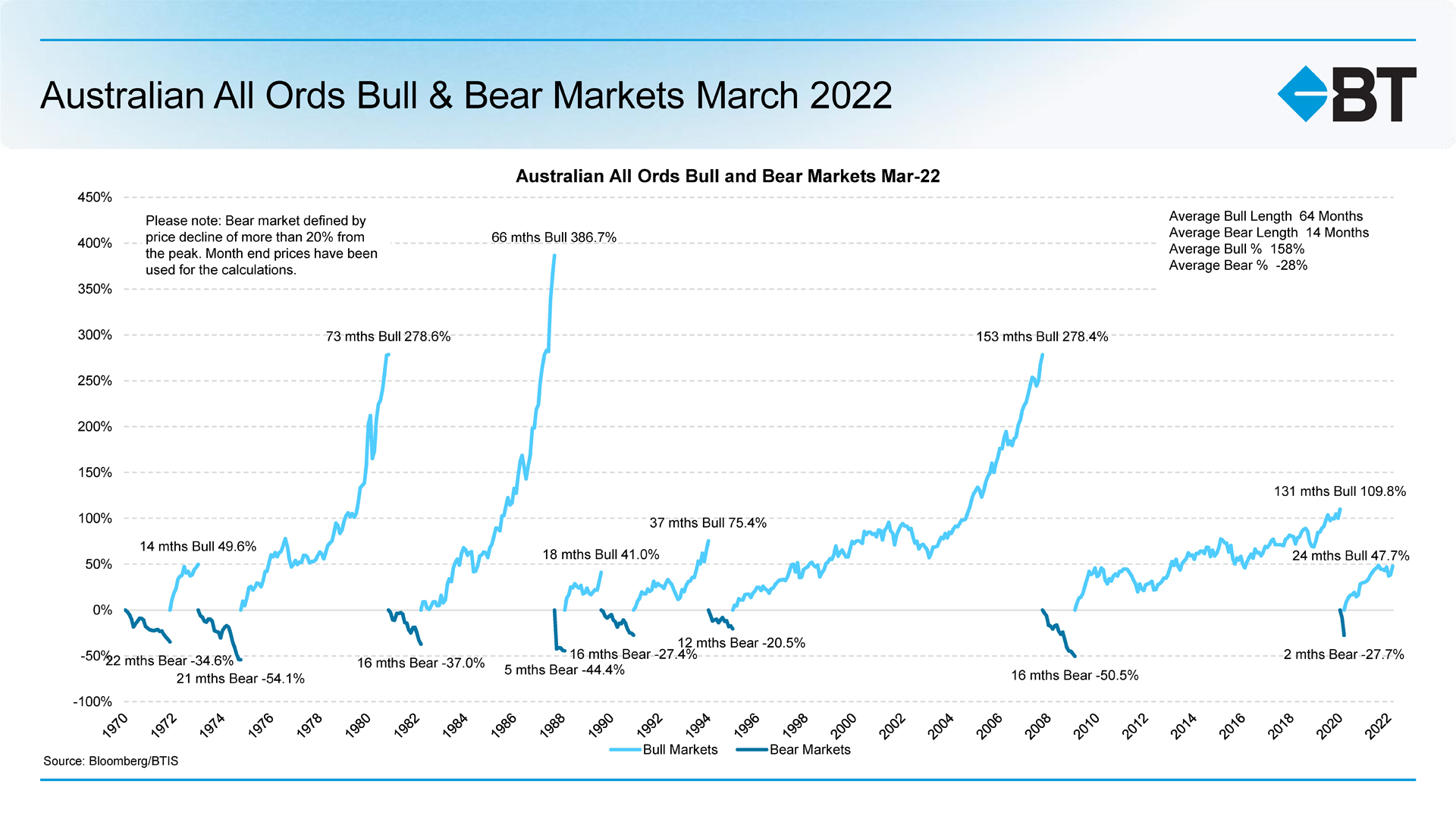

Bull and Bear Market chart from BT which shows how the S&P 500 and the Australian all ords have performed over the last 80 years, specifically highlighting periods of market growth and market decline.

You can see that the light blue line which represents the bulls is more than the dark blue, which represents the bears. Both with the S&P 500, and also with the all ords.

Despite the uncertainties, history does show that stocks do grow over a period of time, reinforcing how time in the market, not timing the market, plays a role when it comes to investing. We are in a very emotional market at the moment, despite the ups and downs, if you average this out, growth is on the cards but at a slower pace.

Bond traders saw the 10-year treasury yield test the 3 per cent level yesterday amid pricing in an aggressive central bank tightening. This saw bonds sell off, leading to yields higher, price lower as market participants adjust to trading in a rising-rate environment.

RBA flags more rate hikes, surprises with 25bp to 0.35%We saw exactly this after the RBA raised its cash rate by a surprise 25 basis points to 0.35 per cent versus the expected 15 basis points with revisions to its inflation and employment forecasts.

The central bank said that now is the time to begin withdrawing stimulus, citing the speed and size in the rate of inflation with evidence pointing to wages growth rising ahead of the May 18 figures. The RBA announced details on quantitative tightening with no surprises with the central bank, favouring a bond roll-off rather than a sale, similar to the moves from the US Federal Reserve.

Oil prices on watchMeanwhile, oil prices fell as China tightened up their Covid-19 measures as it found support at US$100. However, if the Fed plates a surprise interest rate hike, a 75 basis point versus 50, it could send the green back higher which means that commodity prices will fall as it will be more expensive to buy.

Figures around the globeEuropean markets closed higher. Paris added 0.8 per cent, Frankfurt gained 0.7 per cent while London’s FTSE rose 0.2 per cent as BP surged almost 6 per cent, propping up UK equities after boosting its share buyback program. The oil giant cited that its highest profit in a decade was due to strong oil and gas prices

On the London Stock Exchange, Rio lost 1.1 per cent, BP gained 5.8 per cent and Shell jumped almost 2 per cent.

In Asian markets in thin trade, Hong Kong’s Hang Seng added 0.1 per cent while Tokyo’s Nikkei and China’s Shanghai Composite were closed.

Yesterday, the Australian sharemarket closed 0.4 per cent lower at 7,316.

SPI futuresTaking all of this into the equation, the SPI futures are pointing to a 0.6 per cent gain.

What to look out forIn economic news, retail trade is set to be released from the Bureau for March. Given that it’s a backward indicator and the central bank raised rates yesterday, the results could reinforce what we already know, however it could provide colour if hot inflation due to higher fuel costs has started to eat away at consumer spending.

In earnings, we will hear today from Air New Zealand

(ASX:AIZ), Amcor

(ASX:AMC), ANZ Bank

(ASX:ANZ) and Macquarie Group

(ASX:MQG).

Three broker downgrades this morning, Bell Potter cut Fortescue

(ASX:FMG) to sell from hold, Bell Potter also cut Inghams Group

(ASX:ING) to hold from buy, while Morgan Stanley cut Mirvac

(ASX:MGR) to equal weight from overweight.

Ramsay Healthcare

(ASX:RHC) could be in the spotlight amid

The Australian, reporting that the KKR led group is weighing up plans for a potential split off of the real estate held by Ramsay, with property funds group Charter Hall and superannuation giant AustralianSuper among the parties positioning to acquire billions of dollars worth of medical properties.

Outside of ANZ and Macquarie, the big banks are on watch, following the rate hike by the RBA as a lift in interest rates bodes well for their net interest margins, a revenue stream from the rate they charge on lending money.

Flight Centre

(ASX:FLT) said that recovery in travel is in motion, globally with online travel booker saying at he Macquarie Conference that EBITDA returned to profit in March this year.

IPOsThere is one company set to make its debut on the ASX today. Keep an eye out for Koba Resources

(ASX:KOB) after raising $8 million at 20 cents per share. Koba Resources was incorporated by New World Resources in May 2021 for the purpose of demerging New World's portfolio of cobalt assets into a new standalone ASX-listed entity.

Ex-dividendThere are two companies set to trade without the right to its dividend.

Bank of Queensland

(ASX:BOQ) is paying 22 cents fully franked

Waterco

(ASX:WAT) is paying 3 cents fully franked

Dividend-payThere are three companies set to pay eligible shareholders today

Centuria Industrial REIT

(ASX:CIP)Centuria Office REIT

(ASX:COF)New Hope Corporation

(ASX:NHC)CommoditiesIron ore last traded at US$142.35.

Gold has gained $7.00 or 0.4 per cent to US$1,871 an ounce. Silver was up $0.08 or 0.4 per cent to US$22.67 an ounce.

Oil has lost $2.76 or 2.6 per cent to US$102.41 a barrel.

CurrenciesOne Australian Dollar at 7:30 AM has strengthened from yesterday, buying 71.00 US cents (Tue: 70.55 US cents), 56.83 Pence Sterling, 92.39 Yen and 67.47 Euro cents.

Source: Bloomberg, FactSet, IRESS, TradingView, UBS, Bourse Data, Trading Economics, BT