Investment markets and key developments over the past week- US and European share markets rose modestly over the last week helped by more good news on inflation reinforcing confidence that global interest rates have peaked. However, Japanese and Chinese shares fell. Australian shares rose around 0.3% for the week with strong gains in IT, health and telco shares but falls in resources and utilities. The good news on inflation resulted in 10-year bond yields falling another 10-20 basis points. Oil prices were little changed despite a new OPEC+ oil production cutback as traders doubted that the voluntary cutback will be implemented. Metal and gold prices rose but the iron ore price fell slightly. The $A rose above $US0.66 even though the US dollar rose slightly.

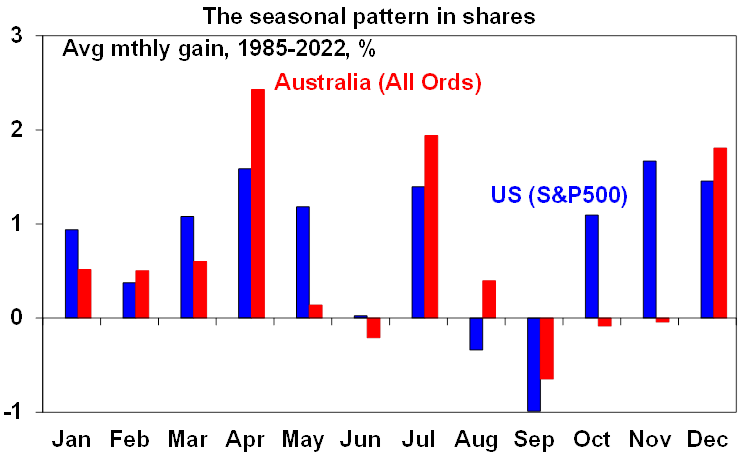

- Shares are technically overbought, but are likely to see more upside. November saw US shares gain 8.9%, which is one of their best Novembers on record, global shares rose 8.1% and Australian shares rose 4.5%. The big rebound in shares has left them technically overbought and at risk of a further consolidation or short term pull back. However, further gains are likely into year end and early next year as inflation continues to ease, the monetary policy environment turns progressively less threatening, economic indicators remain consistent with a soft landing, geopolitical threats likely take a back seat for a while and positive share market seasonality remains in place with the Santa Rally normally kicking in later this month. In terms of the latter, its noteworthy that while November is strong for US shares, seasonal strength for Australian shares usually doesn’t kick in until December.

Source: Bloomberg, AMP

Source: Bloomberg, AMP- That said, there are still significant risks to keep an eye on: sticky services inflation means there is still the risk of more rate hikes or “high for longer” rates; the risk of recession remains high; uncertainty remains high regarding the Chinese economy and property sector; and geopolitical threats could flare up again with US shutdown risk from January 19, ongoing risks around a flare up to involve Iran in the Israel/Hamas war and numerous elections next year most notably in Taiwan (which could affect China/Taiwan tensions) and the US Presidential election later in the year. The risk of another rate hike is perhaps the greatest in Australia and so this could see Australian shares remain a relative underperformer for a while yet. So, shares are still likely to remain volatile.

- But our base case remains that global and Australian shares can trend up as easing inflation takes pressure of central banks and any recession is likely to be mild. But expect lots of bumps along the way.

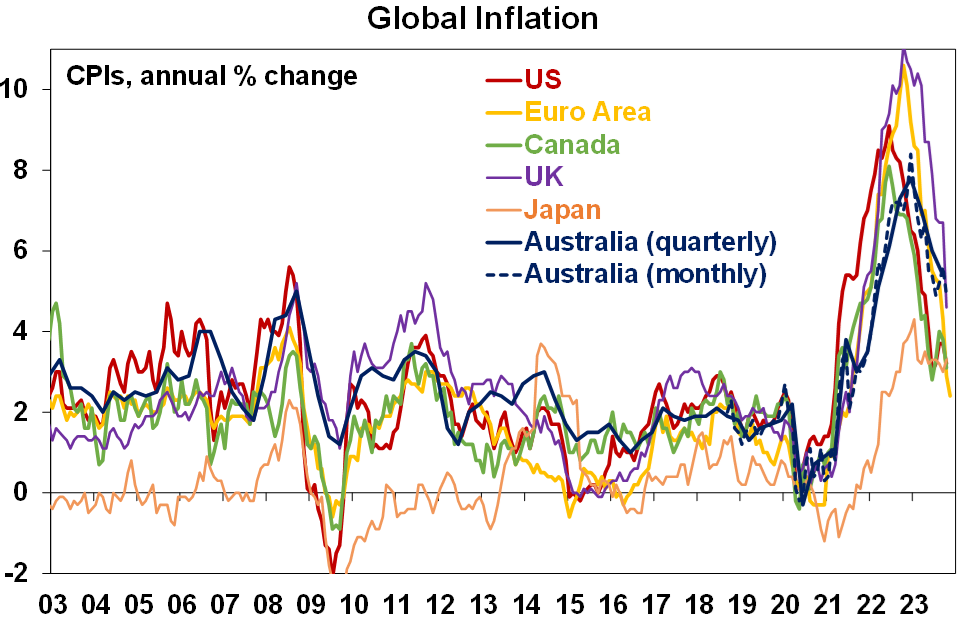

- The good news on inflation continued over the last week. US core personal consumption (PCE) inflation fell to 3.5%yoy in October following the earlier reported fall in CPI inflation. This is below the Fed’s 3.7%yoy forecast for year end! And Eurozone CPI inflation for November dropped far more than expected to 2.4%yoy with core CPI inflation falling to 3.6%yoy. In Europe, this is down from peaks of over 10% and 5% respectively. This is providing increasing confidence that major central banks have reached the peak in interest rates and that rates will be cut next year, which we expect from around mid-year. Fed speakers over the last week remained cautious but most were consistent with the Fed leaving rates on hold this month. In fact, normally hawkish Fed Governor Waller flagged the possibility of rate cuts if the decline in inflation continues for “several more months”. ECB President Lagarde is likely to relax her guidance pointing to no rate cuts in 2024.

Source: Bloomberg, AMP

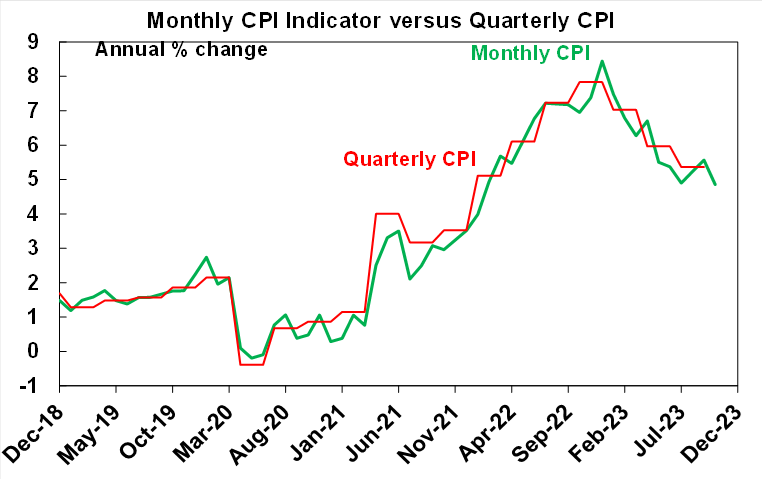

Source: Bloomberg, AMP- There has also been good news on Australian inflation. The Monthly CPI indicator for October came in far less than expected at 4.9%yoy, down from 5.6%, with an implied monthly fall of 0.3%mom. This was driven in particular by weakness in rents (due to increased rent assistance), petrol prices, travel, meat, furniture and household appliances. Of course, the monthly CPI can be very volatile, various subsidies impacted in October, key services (like hairdressing, dental and pet services weren’t measured) and underlying measures of inflation fell by less so there is a case to be cautious, but the good news is that the downtrend looks to be resuming after two relatively higher months.

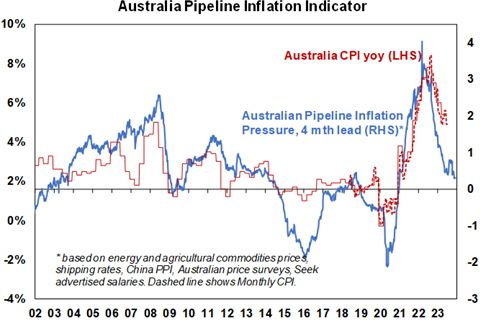

Source: ABS, AMPConsistent with this, our Australian Pipeline Inflation Indicator points to a further fall ahead.

Source: ABS, AMPConsistent with this, our Australian Pipeline Inflation Indicator points to a further fall ahead. Source: AMP

Source: AMP- Monthly inflation could have a three in front of it by December. While some fret that Australian inflation is now well above the circa 3%yoy rates that apply in the US, Canada and Europe it should be recalled that Australian inflation lagged on the way up and peaked three to six months later (partly reflecting the slower reopening from covid in Australia) and it’s doing the same on the way down so there is no reason to be alarmed that its currently higher. In fact, with monthly rises in November and December 2022 of 0.9%mom and 1.5%mom to drop out respectively in the next two months CPI releases we are likely to see monthly inflation with a three in front of it by year end. This will bring Australian inflation more into line with US, Canadian and European inflation – despite all the recent excitement about inflation in the cost of dentistry, hairdressing and pet services!

- We expect the RBA to leave rates on hold on Tuesday but retain a hawkish bias. Comments by RBA Governor Bullock remained hawkish over the last week reiterating concerns about stronger than expected economic activity adding to demand driven inflation and noting that “households and businesses are actually in a pretty good position” and that households coming off fixed rates are “doing fine” implying that households could cope with further interest rate increases. However, she also noted that there are “distributional consequences” from rising rates – which is jargon for some being a lot worse off than others - and that the RBA now had to be “a little bit careful”. In particular, her recent comments lacked the sense of urgency to raise rates that her comments prior to the November meeting had. And since the last meeting we have seen a slight rise in unemployment, softer retail sales, lower than expected inflation and a slowing in national home price growth with some cities seeing price falls. So there is “no smoking gun” to justify another rate hike on Tuesday. That said, the RBA will be cautious about reading too much into the October monthly CPI given several services were not surveyed and underlying measures are still above 5%yoy and so it’s still likely to retain a tightening bias. So, our base case is no change in rates on Tuesday and that the cash rate has peaked ahead of rate cuts in the second half of next year. That said the risk of another rate hike – which would most likely be at the next meeting in February if it occurs - remains high at around 40%. We think this would be overkill but key to watch will be December quarter inflation data due in late January and the next two rounds of jobs and retail sales data. The money market is pricing in a zero probability of a rate hike on Tuesday (which seems a bit too low) and only 26% chance of another rate hike by May next year.

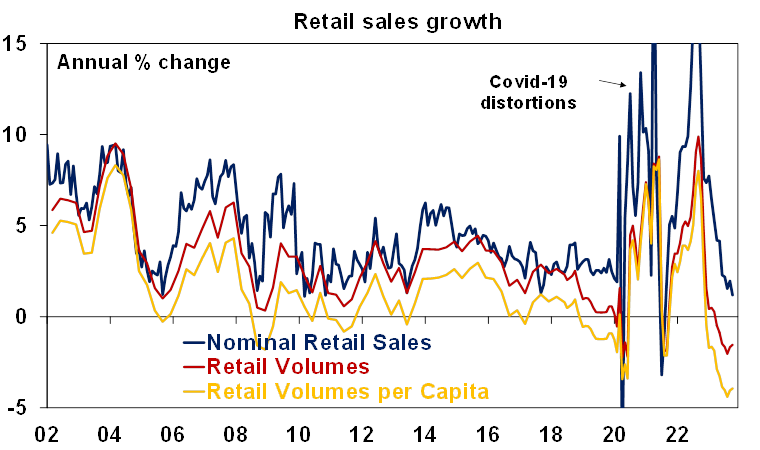

- Are Australian households really in a “pretty good position” and “doing fine” as Governor Bullock suggests? The answer is that it depends on your perspective. So far mortgage delinquencies are low and savings buffers, rising home prices, the strong jobs market and prudent lending standards have all helped protect the average household. So, no problem? But averages are deceiving, and I reckon many households would see it differently. The rise in debt servicing payments due to rate hikes has been huge (eg, an extra $15,000 to $17,000 pa in payments for a borrower with a $600,000 mortgage) and its hard to see this not having a huge impact on borrowers and how much they can spend. In fact, on the RBA’s own analysis combining fixed and variable rate borrowers roughly one in seven were cashflow negative in July and its likely to be even worse now. This means that their income is below their essential living and mortgage costs, with no scope for any discretionary spending. Sure many may be able to run down their savings but there is a limit to this and many have likely already hit that limit – but either way it means a big hit to spending and quality of life which is already showing up in falling real retail sales per person and warnings of weak demand from retailers. And the longer it continues the more it will mean weaker employment and rising unemployment, which will severely question the “doing fine” assessment. All of which underlines the challenge facing the RBA – to bring down inflation but without pushing unemployment up too much – and the need to be “a little bit careful.”

- The appointment of senior Bank of England official Andrew Hauser as Deputy RBA Governor won’t change the direction of interest rates, but it could boost the chance that the RBA will start an active program to reduce its bond holdings, as he has been heavily involved in such at the BoE. This may boost bond yields (and hence fixed mortgage rates) but the experience of other countries with such programs suggests the impact will be minor.

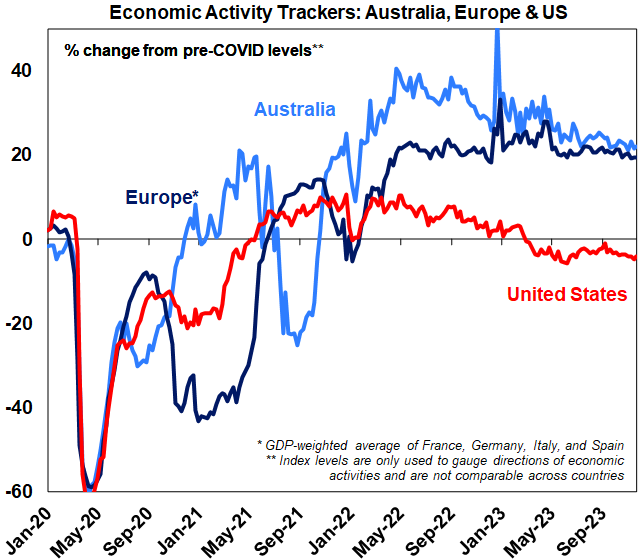

Economic activity trackersOur Economic Activity Trackers are still not showing anything decisive for the direction of economic activity – but they are consistent with just weak growth.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence and credit & debit card transactions. Source: AMPMajor global economic events and implications

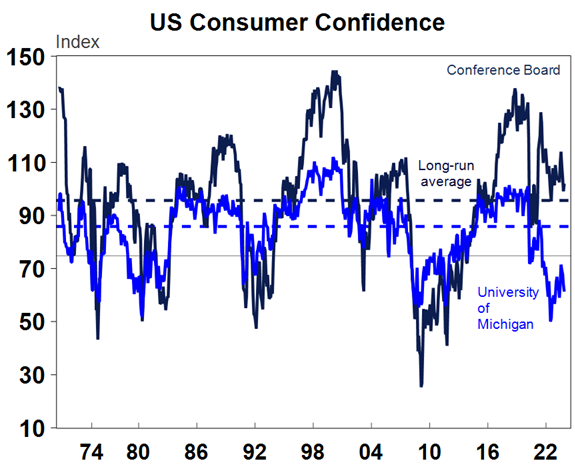

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence and credit & debit card transactions. Source: AMPMajor global economic events and implications- US economic data was mixed remaining consistent with a softish landing, so far at least. September quarter GDP growth was revised up to 5.2% annualised from 4.9% reflecting stronger business investment but weaker consumer spending, but the Atlanta Fed’s GDP Now estimate of current quarter growth slowed to 1.8% annualised not helped by a widening trade deficit. Personal spending also slowed in October, new and pending home sales fell, and jobless claims rose – but more so for continuing claims suggesting that once someone loses a job its harder to find another one. Against this, the Conference Board’s measure of consumer confidence rose slightly and remains around average, although the University of Michigan’s measure is well below average. Home prices also continued to rise in September.

Source: Macrobond, AMP

Source: Macrobond, AMP- Eurozone economic sentiment improved slightly in November but remains weak and unemployment was unchanged at 6.5%. Eurozone money supply and bank lending is continuing to decline.

- Japanese industrial production rose in October but the trend is soft and retail sales slowed. Consumer confidence improved but remains stuck well below pre-pandemic levels.

- The Reserve Bank of New Zealand left interest rates on hold as expected at 5.5%, but its monetary policy guidance and economic outlook was revised in a hawkish way. Another rate hike is unlikely, but it is likely to remain high for longer. Central banks in Korea and Thailand also left rates on hold,

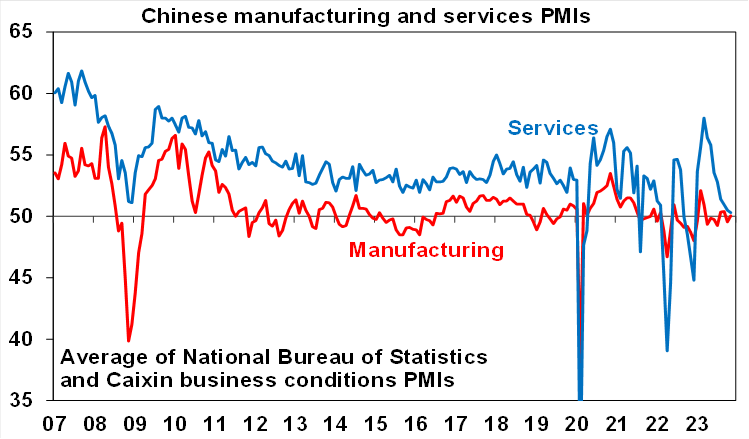

- Chinese business conditions PMIs for November were soft. Recently announced stimulus measures are clearly yet to impact.

Source: Bloomberg, AMPAustralian economic events and implications

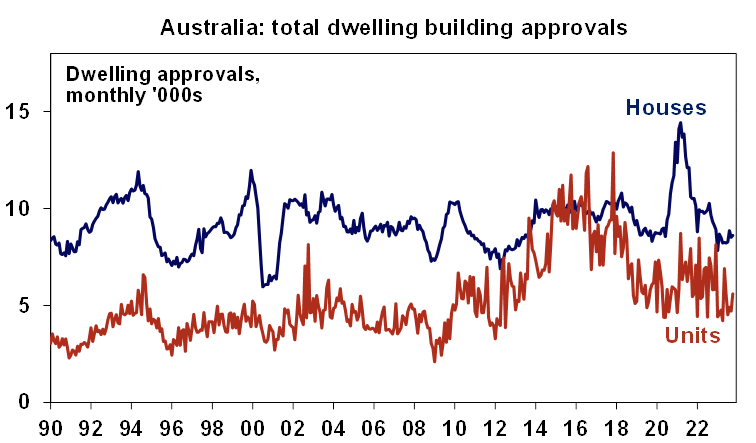

Source: Bloomberg, AMPAustralian economic events and implications- Australian economic data over the last week has been mixed. Building approvals had a strong bounce but this was due to volatile unit approvals. They may have bottomed and there is still a large pipeline of approvals yet to be completed but they remain weak and at around 165,000pa remain well down from underlying housing demand of around 225,000pa. Real construction work done also rose slightly more than expected in the September quarter driven by housing investment and engineering activity.

Source: ABS, AMP

Source: ABS, AMP- On the soft side though, retail sales fell more than expected in October after warm weather, a new iPhone and a few other things boosted sales in September and as consumers waited for Black Friday and Cyber Monday sales. Real per person (or per capita) sales are down by around 4% on a year ago so Australians are cutting back – albeit strong immigration just means that there is a lot more of us. And strong Black Friday and Cyber Monday sales would not necessarily be a sign of strength but more a sign that households are more price conscious now and like last year they are likely to just bring forward spending from December.

Source: ABS, AMP

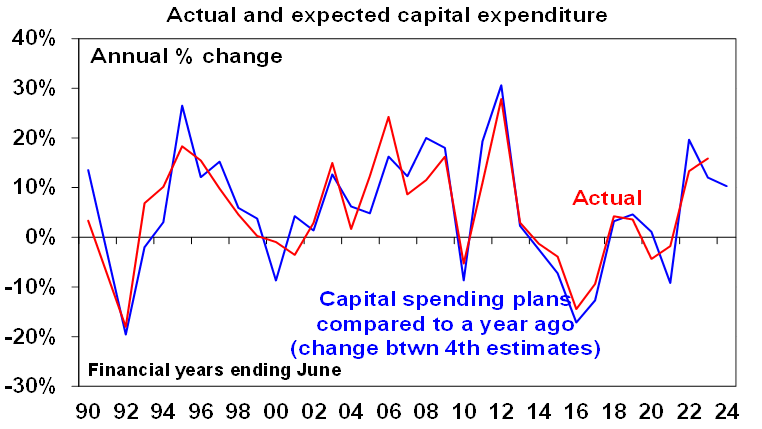

Source: ABS, AMP- Business investment rose a less than expected 0.6% in the September quarter and investment plans for the current financial year point to a slowing in growth. While investment plans are up 10.3% on the same plans seen a year ago their rate of growth is slowing, and this normally coincides with lower investment growth. Note that this also includes inflation.

Source: ABS, AMP

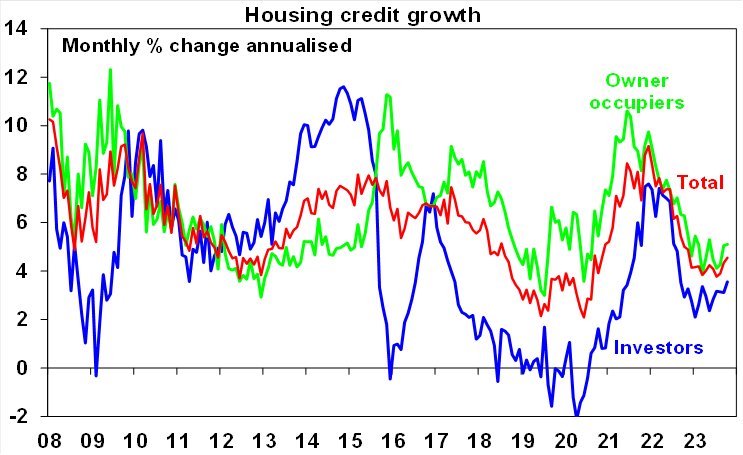

Source: ABS, AMP- Credit growth remains moderate. Growth in housing credit has stabilised but its well down from recent boom time levels consistent with the rebound in home prices this year coming on low volumes which suggests a lack of conviction. Speaking of which…

Source: RBA, AMP

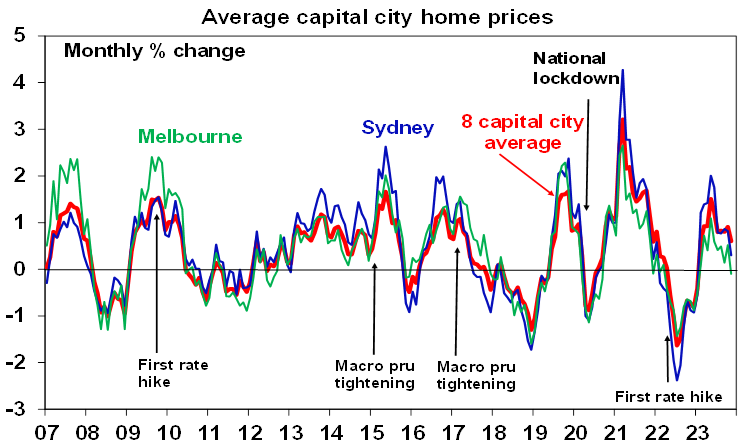

Source: RBA, AMP- Home prices reached a record high in November, but price growth is slowing sharply suggesting the rebound may be coming to an end. CoreLogic home price data for November saw a further slowing to 0.6%mom, with Melbourne, Hobart and Canberra prices down and Sydney price gains slowing to just 0.3%mom. The combination of slowing home price growth since May (when it peaked at 1.2% month on month) and slowing auction clearance rates suggest that housing demand is struggling to keep up with listings. The supply shortfall in the face of strong immigration has had the upper had this year and should prevent sharp falls in prices, but high interest rates and their lagged impact are now starting to reassert themselves. As a result we now expect a double dip fall in national average property prices and are allowing for a 5% fall next year.

Source: ABS, AMP

Source: ABS, AMP- In some good news, the Federal budget for the first 4 months of the financial year is running around $9bn better than projected in the May budget. This largely reflects stronger than expected personal and corporate tax collections on the back of stronger employment and commodity prices than expected. If it continues the projected $14bn deficit for this financial year will turn out to be a modest surplus. While the Mid-Year Economic and Fiscal Outlook, to be released in the second week of December, will likely reflect some of this improvement, reports suggest that it won’t yet forecast a surplus for this financial year and nor will it provide much if any further cost of living relief.

What to watch over the next week?- In the US, the focus is likely to be on jobs data for November (Friday) which is likely to show a pickup in payroll growth to 200,000, unemployment remaining at 3.9% and growth in average hourly earnings slowing to 4%yoy. In other data expect a continuation of the downtrend in job openings and quits data for October and the services ISM for November to remain around the 52 level (with both due Tuesday).

- The Bank of Canada (Wednesday) is expected to leave its key policy rate on hold at 5%, while signaling that it still retains a bias to raise rates further.

- Chinese trade data (Thursday) is likely to show a continuing fall in exports but rising imports.

- In Australia, as noted earlier, the RBA (Tuesday) is expected to leave rates on hold at 4.35% but retain a tightening bias.

- On the data front in Australia, September quarter GDP (Wednesday) is expected to rise 0.4%qoq or 1.8%yoy, reflecting soft consumer spending growth and a small drag from net exports and public spending, but contributions from housing investment, business investment and inventories. This is a slowdown from 2.1%yoy growth in the June quarter. Other data to be released includes the Melbourne Institute's Inflation Gauge, ANZ job ads, business indicators and housing finance (Monday) with housing finance likely to show a 1% gain, net exports and public spending (Tuesday) and trade data (Thursday) which is expected to show a $7.4bn goods trade surplus.

Outlook for investment markets- The next 12 months are likely to see a further easing in inflation pressure and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild. But sticky services inflation, still high recession risk, China worries and geopolitical risks are likely to ensure a few significant bumps along the way.

- Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become dovish.

- Unlisted commercial property and infrastructure are expected to see soft returns, reflecting the lagged impact of the rise in bond yields on valuations. Commercial property returns are likely to remain negative as “work from home” continues to hit space demand as leases expire.

- With the lagged impact of high interest rates appearing to get the upper hand again we now expect national average home prices to fall around 5% in 2024. The supply shortfall should prevent a sharper fall and we expect a wide dispersion with prices still rising in Adelaide, Brisbane and Perth but sharper falls in Sydney and Melbourne. A deep recession and sharply higher unemployment would risk pushing prices below their January 2023 low.

- Cash and bank deposits are expected to provide returns of around 4-5%, reflecting the back up in interest rates.

- A rising trend in the $A is likely into next year, reflecting a downtrend in the overvalued $US and the Fed moving to cut interest rates before the RBA.