Investment markets and key developments over the past weekAfter a couple of weeks of gains global share markets fell again over the last week on renewed concerns about more central bank rate hikes, higher oil prices as Saudi Arabia and Russia extended production cuts, a rebound in bond yields and concerns about China’s economy and its plans to extend its iPhone ban. For the week US shares fell 1.1%, Eurozone shares fell 1.2%, Japanese shares fell 0.3% and Chinese shares fell 1.4%. Following the weak global lead and given worries about China, Australian shares fell 1.7% for the week with falls led by materials, IT, utility and telco shares. Bond yields rose as expectations for further central bank rate hikes rose. Oil prices rose on the continuing production cuts and falling US inventories, iron ore prices were little changed and metal prices fell. European gas prices rose 5% on Friday – but note they are still nearly 90% below their high point last year - as workers commenced escalating strike action at Chevron plants in north west Australia which supply 7% of world LNG. The $A fell with the RBA leaving rates on hold and the $US rising again.

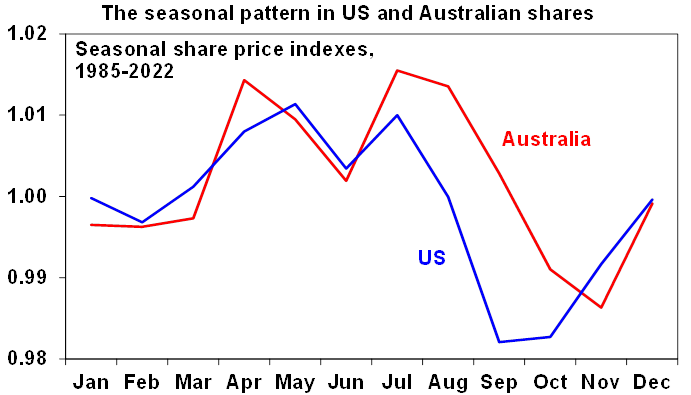

Correction risks remain high. While shares had a nice bounce at the end of August, they failed to break above late July highs and have started to come under pressure again consistent with our view that the risk of a further near-term correction remains significant. The list of threats to share markets in the near term remains long: there is a high risk that the disinflation process could pause and August inflation data in Asia and Europe has highlighted this; many central banks, including the RBA and Bank of Canada in the past week, are warning that they could still raise rates further; the risk of recession remans high; the continuing rebound in oil prices on the back of Saudi and Russian production cuts adds to inflation and recession risks; China’s economy is still at risk with no further policy stimulus; there is a high risk of another US Government shutdown from 1 October if US politicians fail to agree a budget or continuing resolution this month and any resolution is likely to involve tighter US fiscal policy; surging US student loan payments are an additional drag in the US; high bond yields are pressuring share market valuations; geopolitical tensions are continuing with China planning to extent its ban on iPhone use to government agencies and state companies; and the weak seasonal period for shares goes out to October. However, our 12-month view on shares remains positive as inflation is likely to continue to trend down taking pressure off central banks and any recession is likely to be mild.

China’s plans to extend its iPhone ban provide a reminder that the threats to free trade – that started to become obvious with President Trump’s trade wars - are continuing to escalate. This poses an immediate threat to Apple (which gets about 20% of its revenue from China) and to the wider US tech industry if the bans are extended further. Of course, bans on Chinese tech companies have also harmed China’s tech industry. Pushing too far down this path could backfire on China economically with job losses as Apple makes most of its iPhones in China, but national security considerations appear to be increasingly trumping economic considerations (and not just in China). The losers will be consumers with a more inflation prone environment. Australia is also at risk to some degree given that China is our biggest export market, although hopefully the adjustment will continue to occur gradually over time as it has since 2017 and Australia’s improving relations with China may help.

The Australian economy is still growing but its slowing and getting tougher for households. June quarter GDP data provided mixed messages and something to support most perspectives on the economy. On the one hand while growth has slowed to 0.4%qoq or 2.1%yoy its actually stronger than the RBA was forecasting (1.6%yoy), productivity is continuing to fall putting upwards pressure on unit labour costs (which are up 7.5%yoy) and domestic inflation readings remain firm. All of which will concern the RBA and points to upside risks for interest rates. Against this the evidence of a downturn is continuing to build:

- Much of the growth last quarter came from strong population growth of 2.4%yoy, public spending and energy exports, while interest rate sensitive parts of the economy are under pressure.

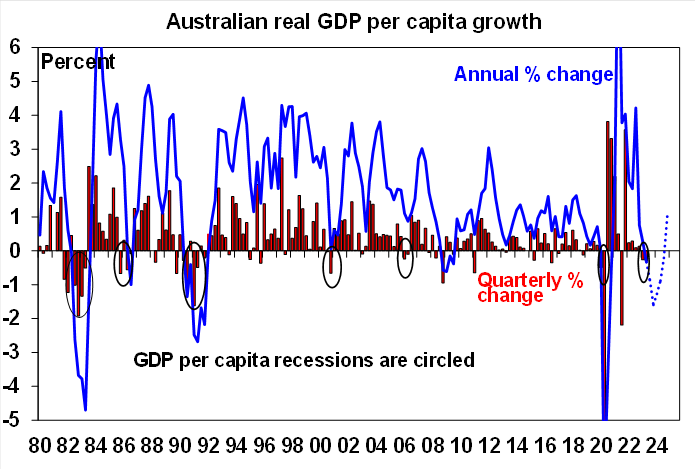

- We are now in a “per capita recession” with GDP per person falling for the second quarter in a row. This explains why people might feel that they are going backwards. In other words, the downturn has been masked by the surge in population growth which the ABS estimates to be running at 2.4%yoy.

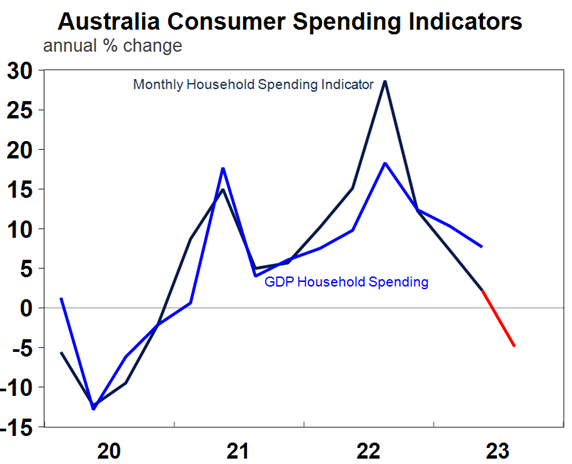

- Private demand is weak. Consumer spending rose just 0.1%qoq and discretionary spending fell for the third quarter in a row. This reflects the hit from higher interest payments, rising tax payments, falling small business income and cost of living pressures offsetting strong growth in wage income. It likely has further to go as rate hikes continue to flow through. Particularly with households now eating into their saving buffers with the saving rate falling to its lowest since 2008. In fact, the ABS’ Household Spending Indicator suggests annual growth in nominal consumer spending has gone negative this quarter (next chart). Home building fell with falling building approvals pointing to more weakness ahead. Business investment rose 2.1%qoq but this was helped by the ending of tax incentives and easing supply backlogs with capex plans slowing.

Company profits are now falling as a sharp fall in export prices (following last year’s energy boom) hit resources profits and this will impact national income and tax payments to Canberra, which will likely contribute to the budget sliding back into deficit.

Our assessment is that there is plenty of evidence pointing to a further slowdown in the Australian economy and this will ultimately dominate the pressures on inflation. We continue to expect a further slowing in GDP growth as consumer spending tips negative, dwelling investment continues to fall, business investment slows and recent strength in public spending and exports moderate with slowing global growth (with China being the main risk). The risk of a conventional recession (ie, two quarters in a row of GDP falls) remains high at around 50%. The expected further slowdown in growth combined with continuing strong population growth will likely at least see the per capita recession deepen further.

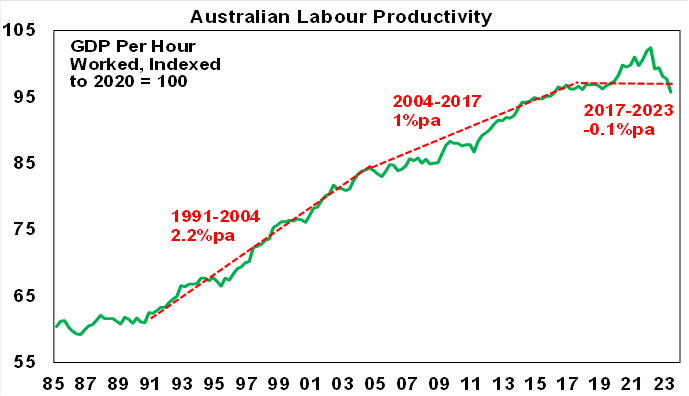

Productivity growth is unlikely to be as bad as it looks, but is still a big concern. The RBA has noted that wages growth is consistent with the inflation target but only if productivity picks up. So far it’s still falling. We know productivity growth has been slowing for years for structural reasons but quite why productivity has fallen so badly over the last year is a bit unclear. However, it may be related to a combination of the normal lag from a slowing economy to a slowing jobs market, labour hoarding and the relative growth of the less productive services sector upon reopening. If so, we should expect some improvement ahead. But fundamental economic reforms (around tax, industrial relations, skills, etc) are required to get productivity growth back to the long-term norm of 1.5%pa.

We continue to see the RBA leaving rates on hold ahead of rate cuts next year. The latest RBA meeting left rates unchanged again as widely expected with few surprises. With inflation still high the RBA understandably retained a tightening bias indicating that the risk of a further increase in interest rates remains high and the further fall in productivity seen in the June quarter and recent surge in petrol prices will reinforce this. However, if as we expect the economy continues to weaken as past rate hikes increasingly bite this will maintain downwards pressure on inflation heading off any further rate hikes and ultimately allowing the RBA to cut rates next year. We are allowing for the first rate cut in the March quarter next year, albeit the risk is that this may be delayed if productivity remains poor, services inflation sticky and if home prices continue to surge (boosting household wealth).

Governor Lowe’s parting remarks. While his last speech didn’t cover the current outlook he made some wise comments which are worth bearing in mind. In particular (and I paraphrase his remarks):

Australia’s flexible inflation target has served us well and it is best to keep it – can’t argue with that.

We are likely to get better outcomes if monetary and fiscal policy are aligned – I agree, but in terms of controlling inflation this would require some way to remove part of fiscal policy from politicians as they are not incentivised to cut spending/raise taxes to slow inflation but they are unlikely to agree to ceding part of fiscal policy to independent experts.

If we can’t build a consensus to act on boosting productivity there is a risk our living standards will stagnate – totally agree.

Monetary policy can’t ignore credit growth and asset prices…but low interest rates are not the reason for expensive housing in Australia but reflect choices we have made about where we live, urban planning, transport and tax – I agree. Low rates facilitated high price to income ratios but other countries have had low rates too so we need to look at choices we have made.

The media has a responsibility too in communicating issues around monetary policy and helping ensure the debate is informed and fact based rather than based on vitriol, personal attacks and clickbait – I agree. Quite how his comments about rates not going up until 2024 based on RBA economic expectations were turned into a “promise” beats me.

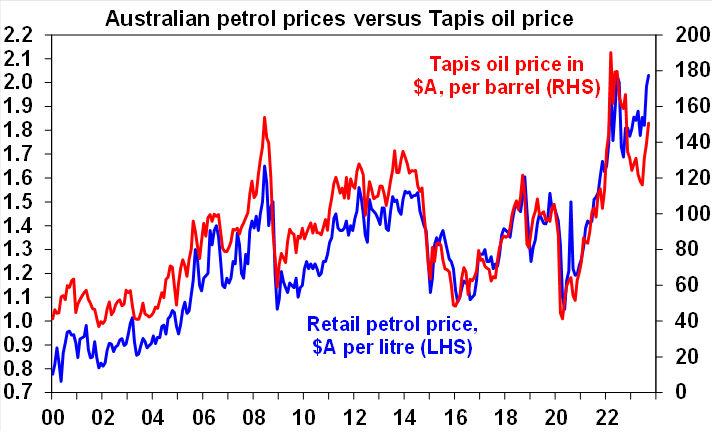

Australian petrol prices back around record levels above $2/litre. The rebound has been due to the rise in world oil prices (with Saudi and Russian production cuts) and the fall in the $A (see the red line in the next chart) and a widening in refinery margins (as evident in the gap between the blue and red lines). If petrol prices stay at current levels, they will be up roughly 5.5% this quarter which will add around 0.2% to September quarter CPI inflation. Fortunately, underlying inflation pressures are now more subdued than they were when petrol prices rose more than 40% over the year to June last year with now slowing economic growth as the reopening boost has run its course and higher interest rates are impacting and much improved goods supply so underlying inflation is less likely to be impacted. But the surge in petrol prices will hurt already struggling households and act as a tax on spending, but at the same time risk upwards pressure on inflation expectations which could add to the risk of another RBA rate hike.

New Covid strains. Just when it seemed we had moved on from Covid two new strains have been doing the rounds – Eris and Pirola – and may be playing a role in an uptick in cases/hospitalisations in Europe and the US. Both are descendent from Omicron but so far there is no evidence that they are more harmful and their symptoms appear to be the same as with previous strains.

Elvis’ Change of Habit. Many of Elvis Presley’s films had somewhat forgettable songs – perhaps because they were being churned out to fill 3 films a year. But a couple of his latter films – Live A Little, Love A Little and Change of Habit had some classics. The latter from 1969 was Elvis 31st and last feature movie and was notable for five reasons. First, it marked a change to a somewhat more mature Elvis albeit the plot line (Elvis plays a doctor in a surgery with three beautiful nurses who were nuns in disguise and falls in love with one) was typical of 1960s Elvis films. Second, it co-starred Mary Tyler Moore who was a bigger star than Elvis had been working with in many of his films. Third, it contained what is believed to be the first film to depict and name autism although the Rage Reduction Therapy shown has gone out of fashion. Fourth, it contains an early scene of folk music in church. Finally, it had a more “trying to be hip” depiction of social issues which Elvis films had largely previously ignored. And it had some cool songs: Change of Habit, Rubberneckin, Have A Happy and Let Us Pray.

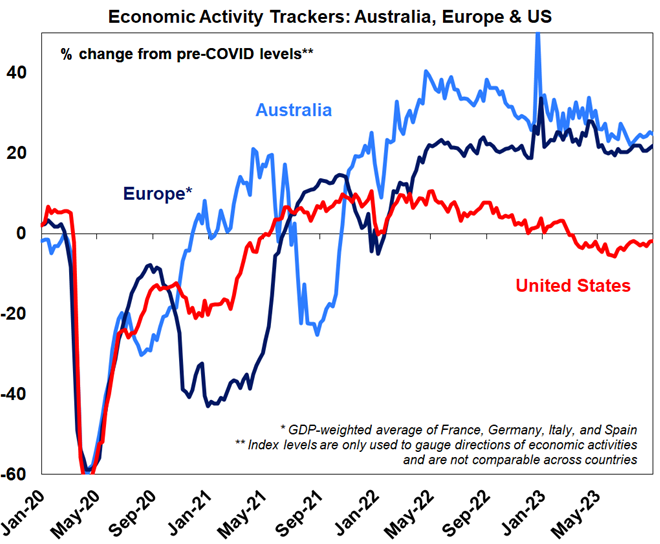

Economic activity trackersOur Economic Activity Trackers are still not providing any decisive indication of recession (or a growth rebound).

Major global economic events and implications

Major global economic events and implicationsUS economic data was mixed. The services ISM unexpectedly rose to a solid reading of 54.5. That said the services PMI (which is a competing business survey) slowed to a soft reading of 50.5. The truth is probably somewhere in between. Meanwhile, mortgage applications continue to trend down as the rebound in mortgage rates impact, but jobless claims fell.

The Bank of Canada left rates on hold at 5% as expected but indicated that it remains prepared to hike again if needed.

Eurozone retail sales fell 0.2% in July and German factory orders fell 11.7%mom in July with industrial production down 0.8%mom with Europe looking at greater risk of recession than the US.

Japanese wage growth slipped back below 2%yoy in July, which will keep the BoJ cautious and gradual in removing stimulus.

Chinese trade data improved slightly in August, with falls in exports and imports moderating which may be consistent with stabilising growth. That said the Caixin services conditions PMI fell more than expected in August confirming the services sector slowdown already evident in the official services PMI.

Asian inflation up in August. Inflation rates rose in Korea, Taiwan, the Philippines and Thailand driven by food and energy with core measures little impacted or still falling. While not a major surprise given higher oil and gas prices lately, coming on the back of something similar in Europe last month it highlights that the fall in inflation won’t go in a straight line & inflation risks remain significant. It’s likely to be a similar story for August inflation in both the US & Australia.

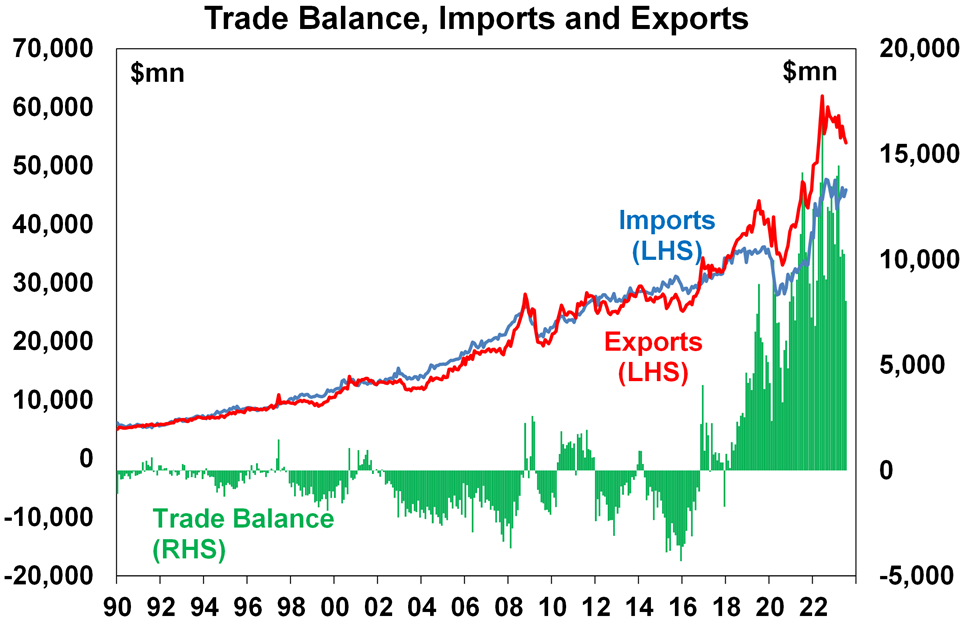

Australian economic events and implicationsApart from the slowdown in GDP growth, other Australian data was a mixed bag. The trade surplus for July fell again with weaker exports for coal, iron ore and gold. It remains relatively high but highlights the risk to export earnings as global growth slows.

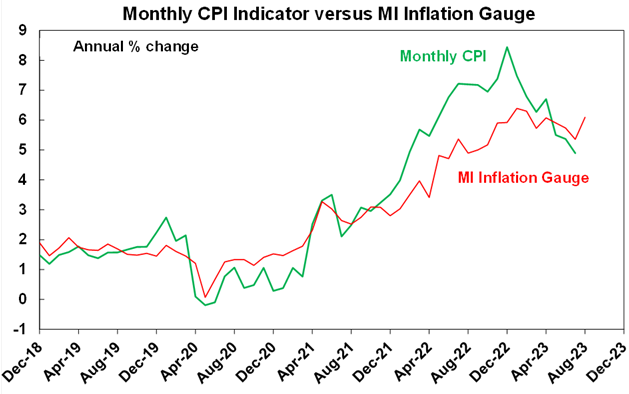

The Melbourne Institute’s Monthly Inflation Gauge picked up to 6.1%yoy in August – but its hard to know how good a guide this as it lagged the ABS’s inflation measures on the way up and so may be doing the same on the way down.

What to watch over the next week?

What to watch over the next week?In the US, the focus will be on August CPI inflation data (Wednesday) which is expected to rebound to 0.6%mom/3.6%yoy (from 3.2%yoy in July) reflecting the rise in oil and hence gasoline prices. However, core inflation is expected to remain at 0.2%mom with the annual rate falling further to 4.3%yoy so we don’t expect this to alter expectations for the Fed to leave rates on hold this month. Producer price inflation (Thursday) is also expected to see an energy related bounce but remain low at 1.5%yoy. Meanwhile, growth in retail sales (Thursday) and industrial production (Friday) are expected to slow after strong gains in July but the highly volatile New York manufacturing conditions index (Friday) is expected to have another rebound albeit remining weak. Small business optimism will be released on Tuesday.

The European Central Bank (Thursday) is expected to leave its key policy rates on hold at 3.75% for its deposit rate and 4.25% for its main refinancing rate, however, its likely to maintain a hawkish bias and the risk of a rate hike is high given concerns about sticky inflation.

Chinese monthly activity data for August (Friday) are expected to show a stabilisation in growth at relatively soft levels with industrial production up 3.9%yoy and retail sales up 3%yoy. Money supply and credit data for August will likely show an improvement after weakness in July.

In Australia, August jobs data (Thursday) is expected to show a 15,000 gain in employment after the 14,600 fall in July with unemployment unchanged at 3.7%. The Westpac/MI consumer sentiment survey for September and the NAB business survey for July will be released on Tuesday.

Outlook for investment markets- The next 12 months are likely to see a further easing in inflation pressures and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild. But for the next few months shares are still at risk of a further correction given high recession and earnings risks, the risk of still more hikes from central banks, rising bond yields and poor seasonality out to October.

- Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become dovish but given the recent rebound in yields this may be delayed a few months.

- Unlisted commercial property and infrastructure are expected to see soft returns, reflecting the lagged impact of the rise in bond yields on valuations. Commercial property returns are likely to be negative as “work from home” hits space demand as leases expire.

- With an increasing supply shortfall, our base case remains that home prices have bottomed with more gains likely next year as the RBA starts to cut rates. However, uncertainty around this is high given the lagged impact of interest rate hikes and the likelihood of higher unemployment.

- Cash and bank deposits are expected to provide returns of around 4-5%, reflecting the back up in interest rates.

- The $A is at risk of more downside in the short term on the back of a less hawkish RBA and weak growth in China, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

- Eurozone shares rose 0.3% on Friday and the US S&P 500 gained 0.1%. Reflecting the slight gains in US shares ASX 200 futures rose 4 points, or 0.1%, pointing to a slight gain in the Australian share market at the open on Monday.