Dr Shane Oliver, Head of Investment Strategy & Chief Economist at AMP, discusses average home prices.Key points:

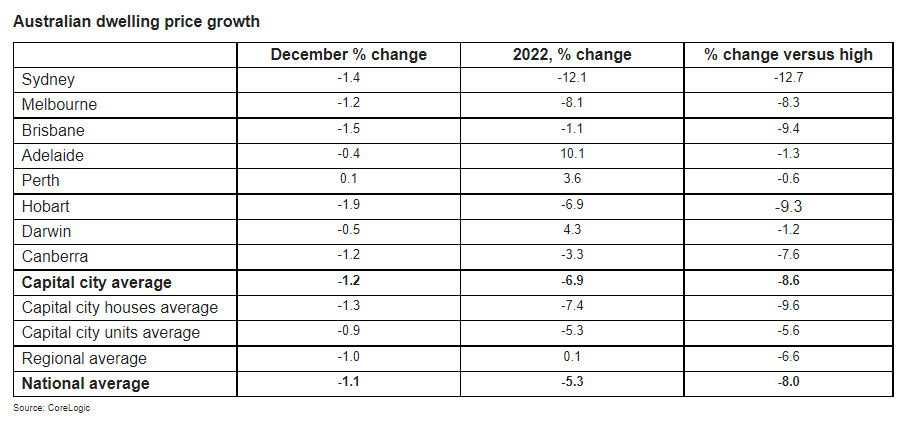

- Australian national average home prices fell another 1.1% in December, with falls reaccelerating from a 1% fall in November.

- Average national home prices are now down by 8% from their April high and fell 5.3% in 2022 - their worst calendar year decline since 2008.

- Average capital city prices have fared worse and are now down by 8.6% from their April high and fell 6.9% in 2022 - their worst calendar year on CoreLogic records that date back to 1980.

- Rising mortgage rates are the main driver of the slump and there is likely more to go. Since April a buyer on average full-time earnings with a 20% deposit has seen a 27% decline in their home buying power.

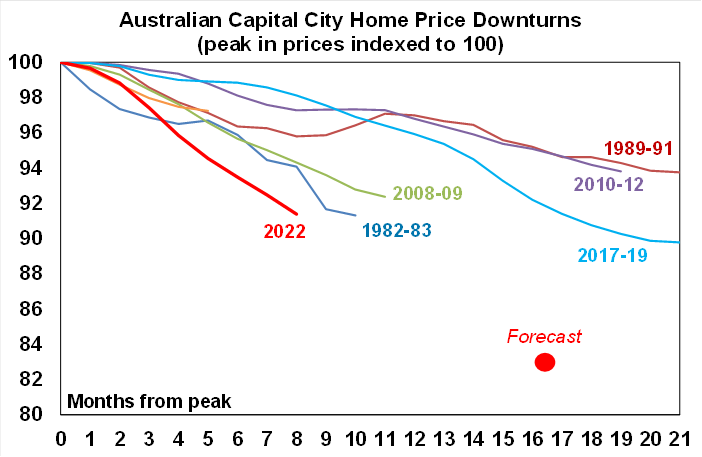

- We continue to expect a 15-20% top to bottom fall in home prices out to the September quarter, as the full impact of rate hikes flows through and as economic conditions slow sharply this year resulting in rising unemployment.

- Reflecting this we see around another 9% fall in prices out to around September, with prices falling 7% over 2023 as a whole.

- House prices are continuing to fall faster than unit prices, reflecting the much stronger earlier boom in house prices and as unit prices are relatively supported by better affordability and tight rental markets. This is likely to remain the case.

The slump in home prices continues

After surging by 28.6% from their pandemic lows in 2020 to record highs in April last year on the back of record low interest rates, home prices are continuing to plunge on the back of the fastest surge in interest rates in decades. Australian capital city average dwelling prices fell another 1.2% in December according to CoreLogic, making it their eighth monthly decline in a row. Including regional dwellings, which fell another 1%, national dwelling prices fell 1.1%. All capital cities saw prices fall in December, except Perth which along with Darwin remains relatively resilient as both cities are still getting over their post mining boom slumps.

Capital city prices fell 6.9% in 2022, reflecting an 8.6% fall in prices since April, resulting in their worst calendar year on CoreLogic records that go back to 1980. National average prices held up a bit better thanks to regional prices peaking later in the year, so average national prices fell 5.3% in the year, which is their worst year since the GFC in 2008.

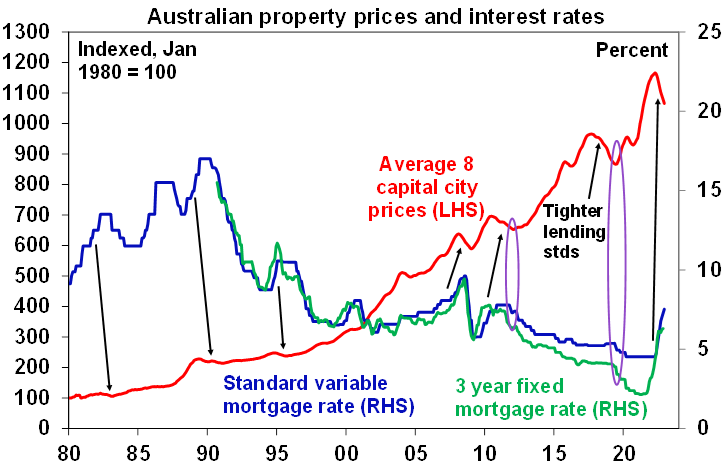

The key drivers of the downturn remain: poor affordability; rising mortgage rates; a rotation in spending from goods, including houses back to services; cost of living pressures, making it even harder to save for a deposit; and poor homebuyer confidence. Rising mortgage rates are the biggest driver of the slump as the surge in fixed mortgage rates for new borrowers, that started in 2021, and then variable rates last year has substantially reduced the amount new home buyers can borrow and hence pay for a home.

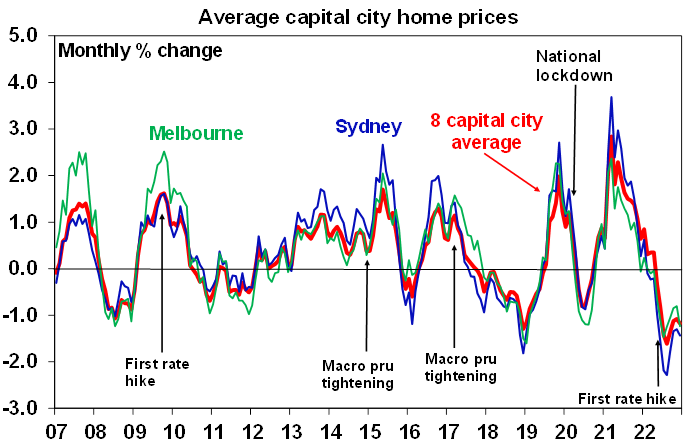

Price falls accelerated again in December, and it’s worth noting that past periods of property price falls experienced a few gyrations in the pace of price declines before prices ultimately bottomed, eg in the 2017-19 down cycle. See the next chart.

Source: CoreLogic, AMP

So far national average property prices are down 8% from their high and average capital city home prices are down 8.6% both over eight months. This is the fastest pace of decline on CoreLogic records going back to 1980. The rapidity of the decline likely reflects the de facto monetary tightening that started with rising fixed mortgage rates a year ago, the speed of RBA cash rate hikes and heightened sensitivity to rising rates due to high debt levels, along with the extent of the prior boom.

Source: CoreLogic, AMP

Of course, average home price levels have still only reversed about 40% of their surge from their pandemic lows. See the next chart.

Source: CoreLogic, AMP

Outlook – we continue to expect average property prices to have a top to bottom fall of 15 to 20%

We expect average property prices to fall further out to the September quarter as rate hikes continue to flow through and economic conditions deteriorate:

- the full impact of variable rate hikes has yet to be fully felt as it takes 2-3 months for RBA hikes to show up in actual mortgage payments;

- while we think the cash rate at 3.1% is at or close to the peak, the risk is to the upside with the money market still expecting the cash rate to be raised to 4% by September – basically three more 0.25% hikes;

- two thirds of the 40% of households with a mortgage on fixed rates will see their mortgage rate reset from around 2% to around 5 or 6% by the end of the year. This is likely to result in a sharp rise in mortgage stress – this is the so called “fixed mortgage rate cliff”;

- economic conditions are set to deteriorate this year as weaker global growth and rate hikes slow the economy & push up unemployment.

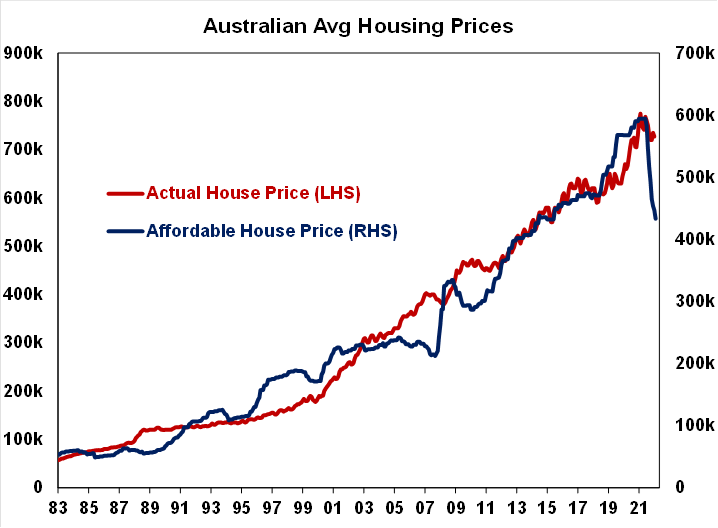

The combination will result in a further weakening in demand and a potential increase in supply as some financially stressed homeowners sell. In terms of the former, the next chart shows actual home prices compared to an estimate of what a buyer - with a 20% deposit, average full-time earnings and mortgage payments assessed at 28% of their income – can afford to pay for a home. The shift in mortgage rates from 17% in 1989 to record lows in 2020 around 2-3% was the main enabler of the surge in home prices and price to income ratios over the last three decades. In other words, record low mortgage rates were reflected in record high home prices. While it can be seen from the chart that there are deviations and there are lots of other factors impacting home prices (supply, immigration, household size, taxation, help from “mum and dad”, home size and quality, and government incentives), over time home prices are tied to what people can afford to pay. But since April the amount an average new buyer can afford to pay has dropped by roughly 27% from around $600,000 to around $440,000. This demand side impact has been the key driver of home price falls so far, but suggests there is much more to go.

Partly based on a Deutsche Bank analysis. Source: RBA, CoreLogic, AMP

In terms of financial stress, with the 3.1% cash rate household interest payments as a share of income are already estimated to be at a near ten year high. Given record debt levels, further increases in mortgage rates will start to push total mortgage payments (principal and interest) to record highs relative to household income. This is likely to result in a sharp rise in mortgage stress – particularly as fixed rate loans reset this year.

As a result of these demand and supply side considerations flowing from higher interest rates, we continue to expect national home prices will have a top to bottom fall of 15 to 20% out to around the September quarter. With prices already down by around 8% from their high this implies another 9% of so fall yet to come. Late in the year a move towards rate cuts may enable home prices to start rising again trimming the expected decline in prices for 2023 to around 7%.

The main risks on the downside are that the RBA raises the cash rate to around 4% (as the money market is assuming) and the economy enters recession. The RBA has already raised rates by more than the 2.5% interest rate serviceability buffer that applied up to October 2021. In this scenario home prices could fall by around 30% from their high.

On the upside several factors will help put a floor under prices and eventually drive a recovery. These include: government support programs (eg, home deposit schemes, “Help to Buy” schemes and NSW first home buyers swapping stamp duty for land tax); the tight rental market; & rapidly rising immigration. But for now, the property market will be dominated by higher rates. A pause in rate hikes on its own is unlikely to be enough to drive an upswing in prices as the capacity of buyers to pay will still be depressed. The last two major upswings in property prices that started in 2012 and 2019 required rate cuts before prices started to rise - see the purple ovals in the third chart in this note. Right now, we don’t anticipate rate cuts to start until late this year or early 2024.

Ends

Important note: While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.