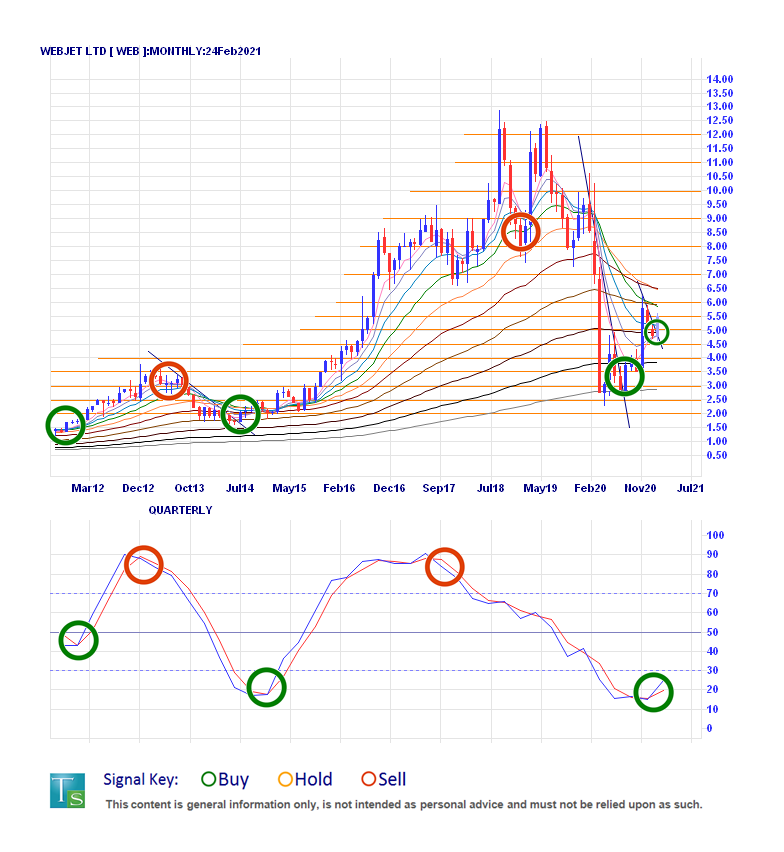

Date of Data Capture:

24/02/2021

Name:

WEBJET LIMITED (WEB)

Classification:

Travel Agent

Current Price:

$5.50

Market Capitalisation:

$1.86 B

Forecast Sales Growth:

297.30%

Yield Estimate:

0.00%

Consensus Price Target:

$4.72

# Covering Analysts:

9

Premium at Current Price:

+12.10%

Price Target Trend (3-Month):

Up-Flat +24.21%

Signal Timeframe:

Quarterly-Monthly-Weekly

Trend Bias:

Up-Down / Long-Medium

Indicators:

Short-term:

Positive-Neutral

Medium-term:

Positive

Long-term:

Positive

Recommendation:

Buy

Focus:

Capital Growth

Set up Notes:

• Embattled travel agent WEB looks to continue tripping higher here as the prospects for the opening of the Global economy come closer, and there is a lot of room for recovery here.

• Last year the company saw its history of good and consistent sales and earnings growth collapse in lockdown losses, but forecasting is improving strongly with good growth potential.

• The chart tells the tale well, with a strong uptrend running from 2014 to the start of 2020, before being brutally crushed – here we find WEB on its 2nd recovery wave, breaking major resistance, setting up old targets higher above.

Support ($): 5.00, 4.50, 4.00, 3.50 & 3.00.

Resistance ($): 6.00, 7.00, 8.00, 10.00 & 12.00.