Date of Data Capture:

15/7/2017

Name:

ONEVUE HOLDINGS LTD (OVH)

Classification:

Professional Information Services

Current Price:

$0.62

Market Capitalisation:

$163M

Forecast Sales Growth:

61.65%

Gross Yield:

0%

Consensus Price Target:

$0.94

# Covering Analysts:

2

Discount at Current Price:

51.61%

Price Target Trend:

Increasing Flat

Signal Timeframe:

Monthly-Weekly

Trend Bias:

Up-Down Long-Medium

Indicators:

Short-term:

Positive Neutral

Medium-term:

Positive

Long-term:

Positive

Recommendation:

Buy

Focus:

Capital Growth

Set up Notes:

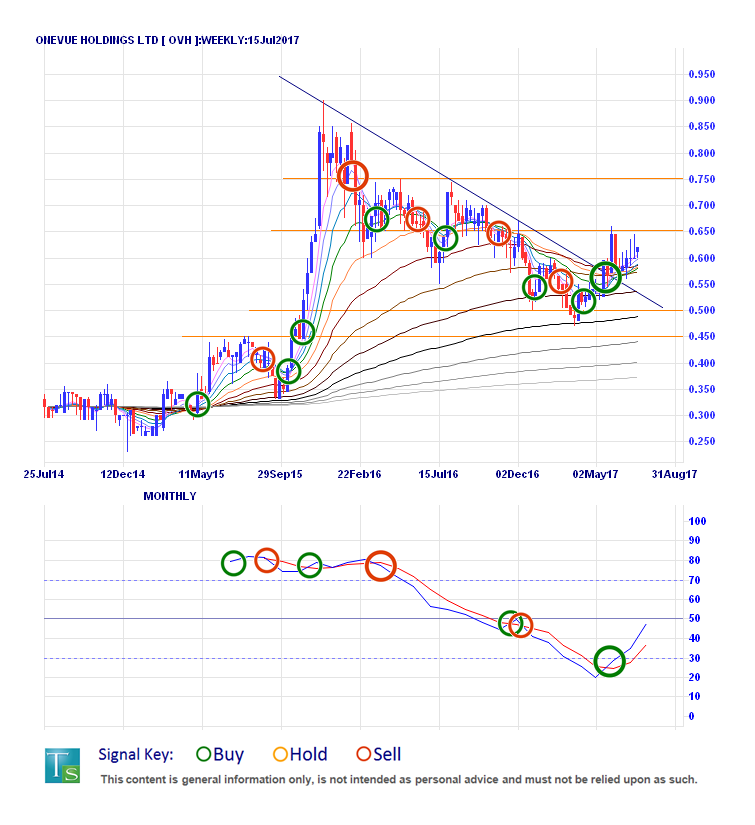

• We have another stock that became a victim of its own exuberant success, running up by 300% during 2015, before falling 50% throughout 2016.

• After clearing through linear resistance in May, OVH has seen an initial price bump up to structural resistance at 65c, which held to push pricing back to test new support at 55 and 60c.

• We have been waiting for a good entry opportunity and for the short-term cycle to turn positive again, which happened a few days ago and we should now see positive momentum combining across multiple timeframes here.

• We have structural overhead resistance targets at 65, 75 and 85c, with good support layered down to 55, 50 and 45c if more volatility ensues.

Growth Focus:

OneVue Holdings Ltd (OVH)

Our primary focus here is capital gain, we will select our stocks from the ASX top 500 All Ordinaries Index.

When making our stock selections we like to take in many different points of view, to scour varying timeframes, access all available valuations and review past performance and future forecasts. This would ironically set us against our selection of OneVue Holdings Ltd (OVH), but with a good balance of fundamental strength and technical allure, we see an investment services company whose improving prospects deserve more than a backward glance.

First appearing on site in Sydney early in 2004 as a platform services provider, OneVue would list on the ASX ten years later having grown into a leading innovator of wealth management technology. Offering administration and distribution services to funds and platforms, and catering to the massive and still growing self-managed superannuation market offers plenty of scope for continued organic growth in addition to their active acquisition strategy. Despite recent purchases they remain cashed up, debt-free and poised to now push through to the point of net return.

We need to highlight that they do not yet make a profit nor offer a dividend – but we are here for growth and OneVue has had plenty of that in the past. Most recently they have been consolidating a major rally, giving fundamentals a chance to catch up with prices that have been falling under the weight of too heavy expectations coming too soon. That consolidation may have ended with their last set of results showed EBITDA growth up over 200% with aggressively strong gains also seen in sales and earnings forecasts, which could see them become cash flow positive this year. This would be an important milestone and would be bound to attract even further attention to this (as yet still small) company that could be about to step into the spotlight.

Despite its modest size, OneVue offers decent liquidity and volume – no doubt this residual attention comes from their remaining under the watchful eyes of many investors still dazzled by their near 300% rally over three months at the end of 2015. From that all-time-high prices ground lower over the next year and a half a clear linear downtrend that broke in May 2017 after falling close to 50%. That resistance break was important and we have since been waiting for positive shorter-term signalling to light up a favourable entry, which we see here and now.

From the May breakout above 55c, pricing rallied to hit old structural resistance around 65c - which held successfully - causing OVH to fall back to test new support at 55 and 60c. With the short-term cycle turning positive we should be able to see increased potential for a bigger break as momentum combines across timeframes. On the upside we have structural resistance targets at 65, 75, and 85c – with decent structural and dynamic support well-layered down from 55 to 45c if we are a cycle early.

OVH has blue chip investors, management with skin in the game, excellent historical growth and very exciting forecasts ahead of them - if you cannot see their potential, you might just not be looking at OneVue the right way.