Date of Data Capture:

30/6/2016

Name:

1300 SMILES LIMITED (ONT)

Classification:

Healthcare Services

Current Price:

$7.15

Market Capitalisation:

$168M

Forecast EPS Growth:

9.8%

Gross Yield:

3.1%

Consensus Price Target:

$7.43

# Covering Analysts:

3

Discount at Current Price:

3.9%

Price Target Trend:

Increasing Flat

Signal Time Frame:

Monthly/Weekly/Daily

Trend Bias:

Up Flat Long/Short-term

Indicators:

Short-term:

Positive

Medium-term:

Positive Neutral

Long-term:

Positive

Recommendation:

Buy

Set up Notes:

• ONT continues to travel higher on the back of a good long-term trend with steady growth forecast to continue.

• Coming out of a short-term consolidation, staying above $7 support and looks ready to run again, with further support at $6.50.

• Not the most liquid stock so we don’t want to chase but rather use these small pullbacks to gain a favourable position.

Growth Focus:

1300 SMILES LIMITED (ONT)

Our primary focus here is capital gain, we will select our stocks from the ASX top 500 All Ordinaries Index.

The time has come to turn our eyes to a new growth target and as that target is dental healthcare provider 1300 Smiles Ltd (ONT) the time could well be 2:30... (pun intended). With a name as clinically proficient as their business model we see some real potential in what they could yet add to their already strong performance with increasing economies of scale.

Headquartered in Townsville, North Queensland, 1300 Smiles is a growth story that keeps growing, while keeping cash flow and profits well-guided. Seemingly indentured to a solid and steady expansion throughout eastern Australia, there remains plenty of room left to grow through their ongoing build or buy strategy and recruitment of self-employed specialists and professionals.

Focussing on full-service dentistry, ONT offers complementary services within a contained and cohesive setting. This is a model that has delivered impressive performance so far and should continue to be successful as they grow in size.

A small but respectable dividend of 3.1% is an added bonus but we are happier still when we look at recent growth in sales, margins, income and profit as further support to forecasts of the dividend increasing to roughly 3.4% next year. Something else to smile about is the current price discount to consensus targets of just under 4% which puts us on the right side of the aggregate valuation.

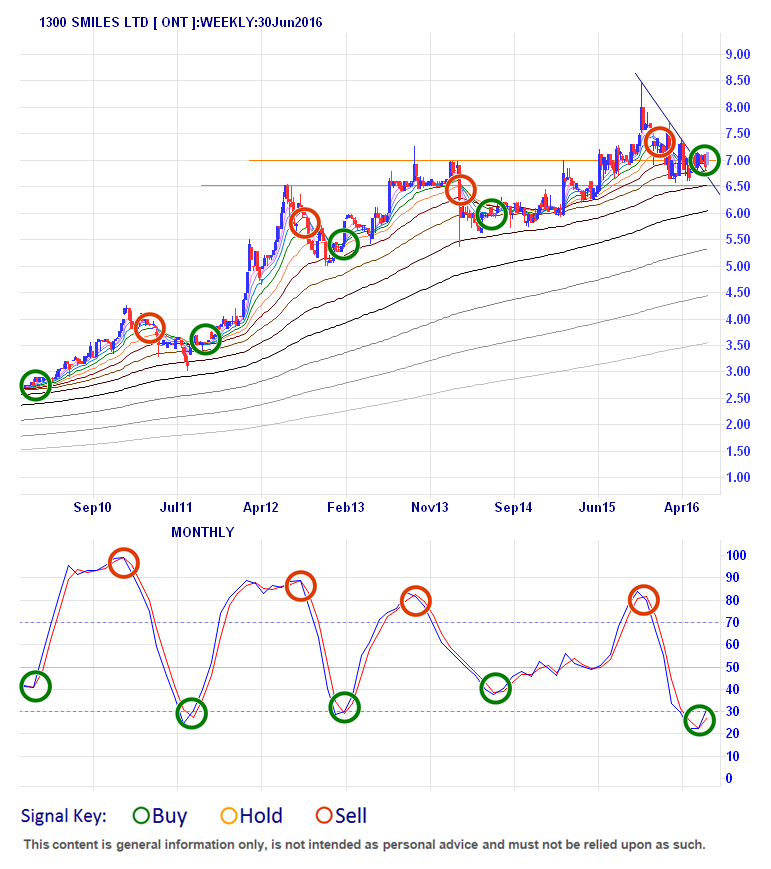

The dominant trend running through 1300 Smiles is best seen through a longer-term monthly timeframe, though the current Buy signal is also supported in the shorter weekly and daily timeframes. Interestingly, we have these signals presenting just as the stock is coming out of a mostly sideways consolidation that has been in place since November 2015, breaking through linear resistance early in June 2016.

This reinforces the major positive long-term signal we have seen emerge once again this month as the price pushes off support at $7.00. Previously this signal has correlated well to strong uptrends, the most recent signal mirrored a run from $6.00 to almost $8.50 in under a year. The completion of this consolidation could be part of a bigger and longer-framed move with the price successfully retesting the breakout zone of structural resistance established in 2013 and broken on the last rally. While there is no dynamic resistance above us, there does remain some further structural resistance at $7.50, $8.00 and from there up to the old high of $8.47.

These resistance points should also act as price targets once the uptrend is established - and we see early signs that this nascent rally could be emerging right now. Liquidity can be thin at times and any rally could be prone to spikes up and down, so expect volatility going forward. That said, with a great overall growth profile that really suits our tastes, we see ONT as a stock we could really sink our teeth into.