CWN is in a position that many listed companies would love to be, having a strong pipeline of projects that it can invest in to boost future returns and earnings. Its Melco Crown JV in Macau has three development projects underway; the Studio City resort to be completed by mid-2015, the fifth tower of the City of Dreams Macau has an anticipated opening in early 2017, and the City of Dreams Manila resort (in partnership with Belle Corporation) which will open its doors to the public in late 2014. The reason why analysts focus so much on the Macau JV is the high growth nature of the business, highly leveraged to gaming volumes from mainland China, which is the traditional source of Macau’s double digit growth in annual gaming volumes. With an emerging middle class in China who have disposable income to spend on both travel and gaming entertainment, Macau has been a destination of choice due to its proximity and the availability of tours that each year bring large numbers of people in from the mainland.

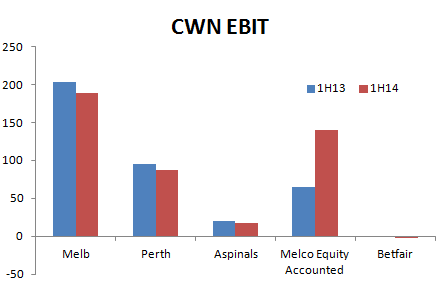

The core casino businesses in Melbourne and Burswood (Perth) offer steady sources of revenue and in recent times has been able to attract additional volumes due to a strategic program of investment via facility refurbishments. The Melbourne investment program consisted of the construction of the new Crown Metropol hotel in 2011 and a refurbishment of existing gaming and entertainment facilities within the resort. CWN has invested over A$1 billion of capital in its Melbourne assets and is now seeing a strong uplift in revenues as it enters the profit harvesting phase of the program. There is a similar investment program underway at the companies Burswood casino in Perth, where CWN has already spent about $500 million. A further A$500 million will be spent over the next 3-4 years which include a number of initiatives, such as the development of the “Sky Salon” hotel resort, refurbishment of Crown Metropol Perth, completion of the “Mansions” VIP villas, and an expansion of various entertainment facilities. We expect the Burswood investments to be in revenue harvest mode by FY17.

The Australian gaming market is in a mature phase of its development and from the revenue breakdown of CWN it is clear that casino operators derive most of their volumes from the mass market. The operator licenses at Melbourne and Burswood (Perth) are long life with expiry dates of 2033 and 2060 respectively, the monopoly status of the agreements give CWN certainty in the form of stable and predictable future earnings from mass market volumes. By far the most exciting opportunity that the company has is its exclusive right to develop the Crown Sydney Hotel Resort, which is a casino and entertainment complex nestled in the heart of the new Barangaroo precinct. The resort is expected to be fully operational by November 2019 and will take away the exclusive casino operator rights of Echo (The Star in Sydney) in Sydney.

Owing to the lack of land and labour constraints, Melco Crown is also looking to other countries to expand its casino resort empire. Other than the Manila City of Dreams the company has begun discussion with the Sri Lankan government to develop a casino resort in Colombo. The strong pipeline of investment projects put CWN in a unique position as a high growth company. Given the huge list of growth projects which CWN has in its portfolio we classify the company as a high growth opportunity. As compared to similar growth companies in the market we consider its 18.4x multiple based on 12 month forward earnings as reasonable.

Since beginning the uptrend in 2012, CWN has been rallying very strongly, seeing the share price more than double in that time. However in January CWN formed a double top on the weekly chart, before proceeding to be sold off fairly strongly. It also occurred while exhibiting divergence with the RSI. Since then, the share price has bounced back but it is still struggling to get through the mid $17 area which appears to now be strong resistance. Over the next few weeks or so, CWN therefore has the potential to weaken further. We anticipate levels around $15 - $15.50 before it finds suitable support. Investors should therefore consider holding off their purchases of CWN until it hits those levels.