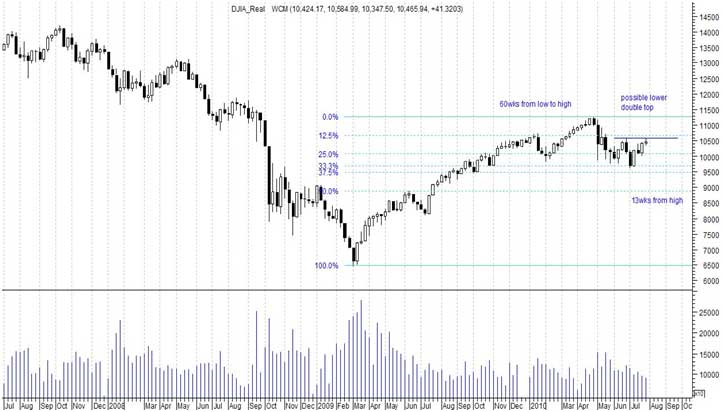

Dow Jones

Although volumes have just started to pick up it’s still not overly convincing this rally. The 4 week rally has been mild and the consolidation period we should expect after following a rally that lasted 60 weeks should last longer than 13 weeks, so our neutral range bound call is still firmly in place. What is of concern is the lower double top possibility. Double tops have such a high failure rate it is hard to view them too seriously, but once we have a trend in place, or in this case you have a peak followed by a lower high then the results are just the opposite as this becomes a high probability bearish set up. The 13 weeks (or for our Gann enthusiasts – 90 days) is a very important timing window and the lower high set up gives us another bearish signal to be very wary of.

View: If this rally is going to fail, then it will do it right here. The Dow Jones will need to close above 10594 to cancel out this possibility. The last time I saw this similar set up it didn’t end well so we need to be very cautious here.

Commonwealth Bank

This is a very similar set up to the previous Dow Jones chart and again the lower double top is a real possibility. The last thing on the chart is a mild 4 week rally which has followed a sharp 2 week fall and price has failed to go to a new high in twice the time it took to move down. Also the biggest volume spike has come in last week after the rally has taken place and this could be a short term exhaustion sign.

View: The stock is in a weak position after a feeble rally and the lower double top is a major concern.

Map Group

Very similar pattern to the last two charts, it’s a bit of a concern when this pattern keeps on popping up all over the place currently. The volume of last 4 weeks rallying has been very low so this rally again is not that convincing. A bearish reversal here will see a new low in less than 4 weeks so a short trade looks ideal with a stop just above the last peak of $3.05.

View: This weak rally up to the previous lower high is a great shorting opportunity because risk reward presented is ideal. If your wrong you will get stopped out straight away for a small loss and if it turns it will move a lot and the reward will be large.

Tatts Group

The gambling sector is one of the few bright lights at the moment. Tatts Group has recently broke up out of a small downtrend and has had a nice rally. The volume is a little low so this is a bit of a concern longer term. The most interesting thing about TTS and TAH is that they both have been caught in a large sideways trading pattern and this could be a large basing pattern. Large moves often follow these types of large basing patterns so something significant is possible here.

View: The volume for TAH has been very firm so this could indicate some buying interest currently and a break above the downward trend line would probably be accompanied by a breakout rally. If price can break above $7.00 then a quick move towards $7.70 is likely.

Tabcorp Holdings